NGOs have been obliged to open their foreign currency accounts at the Burundi Central Bank (BRB) since last April. Some of them and individuals receive transfer of funds via Rwandan and Congolese banks.

“Following the decision of the bank of the Republic of Burundi, we created an account at Ecobank in RWANDA,” says N.T., one of the finance officers of one of the NGOs operating in Bujumbura. She says her organization has opened an account at BRB which it does not use.

“Following the decision of the bank of the Republic of Burundi, we created an account at Ecobank in RWANDA,” says N.T., one of the finance officers of one of the NGOs operating in Bujumbura. She says her organization has opened an account at BRB which it does not use.

Article 14 of the Finance Act 2016 stipulates that all foreign-currency accounts of NGOs receiving external support must be open to the BRB. According to that same article, it is the central bank which, at the request of beneficiaries, puts at their disposal the compensation in BIF in accounts open at BRB or in commercial banks.

N.T. says the central bank and commercial banks offer very low exchange rate. They offer BIF 1925 for 1 Euro whereas the comparable market offers BIF 2990, she explains.” A commission rate of more than 60%!”

She says that instead of the 6000 Euros of the commission rate to the same amount, her organization uses 70 Euros for transportation fees to withdraw 10.000 Euros from Ecobank Rwanda.

She rejoices that her organization has recuperated more than 64000 Euros in less than a year. However, she says she has spent 770 Euros for a transaction which could have been operated in Burundi without any cost.

She says their sponsors transit their funding for projects by that account.

“I lose my time and money”

K.J. says his brother who lives in US was used to sending him money through Bancobu before the decision of the central bank: “My brother is building a house at Kibenga area. Now, transfers are not operated at Bancobu as it was before.’’

He says his brother transfers the money at RawBank in Bukavu located in RDC. He says Bancobu gives BIF 170.000 for 100 $ whereas the comparable market gives BIF 266.000 to the same amount. “From July 2016 till today, he has sent 7000 Dollars,” he says.

He also says that transportation fees used to withdraw that amount are estimated at BIF 60.000. “Why does BRB oblige them to spend such amount?”

‘‘My husband has been living in Belgium for three years. He sends me money via BCB’’, says R.L., a mother of three children. She says she now prefers to transfer the money to the KCB Bank of Butare. She says her husband has sent her 3000 Euro since April 2017. R.L. says the withdrawal of that amount cost him BIF 250.000. However, she mentions that she has gained BIF 800.000. “But I spend my money and time.”

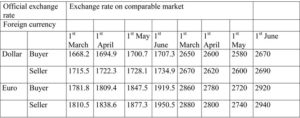

Exchange rate evolution from March 1st to June 1st

Source: Survey by Iwacu Newspaper, June, 2017

IWACU Open Data

IWACU Open Data