Maize seeds, maize flour, manioc, cassava flour, rice and beans have been exempted from customs duties since 15 May. Burundian Association of Consumers (ABUCO) denounces that only importers benefit from this tax exemption.

Noël Nkurunziza: “The prices of exempted food products are almost unchanged on the market.”

“Consumers have not yet benefited from the tax exemption of imported food”, says Noël Nkurunziza, ABUCO President, on Tuesday 20 June. He says it is the traders who take advantage of it. “The prices of exempted food products are almost unchanged on the market”, says Nkurunziza.

ABUCO President, furthermore, says only prices of local products tend to fall especially beans and maize seeds. He points out that this fall in price is due to the harvest effect; consequently, it will not last long. He calls on the government to set up a monitoring commission for evaluation and orientation proposal. “If nothing is done, consumers will be in the same situation as before tax exemption”, Nkurunziza warns.

“No huge profit for traders”, says Gloriose Nahimana, an importer of maize flour and rice. “Cost price of a bag of 25 Kg of maize flour imported from Uganda amounts to BIF 47,000”, says Nahimana.

“No suppression, but a simple reduction”

Mrs Nahimana says a 25 Kg bag was sold at BIF 50,000 against 53,000 before the exemption. Concerning the rice, she says a 25 Kg bag imported from Tanzania could be bought at BIF 62,000 compared to BIF 65,000 before the tax exemption. Nahimana explains this slight reduction in price by a small reduction of certain customs duties and taxes.

She also points out that the tax exemption measure bothered the traders: “with the exemption, traders expected massive imports of exempt products. Imports are, however, limited”. Nahimana says, in addition, that the prices of exempted goods are not reduced because of shortages in the countries of origin.

Nestor Gahungu, another importer of foodstuffs, makes the same argument. “It is not a question of abolishing customs duties and taxes, but of a simple reduction”, says Gahungu. He has just spent a month without importing any products due to the slump of imported products. He acknowledges that he did not change his prices in favor of exemption. “Some consumers prefer relatively cheaper local flour,” he says.

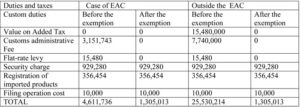

For different goods, with the same customs value imported into the East African Community, customs duties remain the same.

Flat-rate levies (FRP) are advances that the trader pays and recovers them at the end of the year when the declaration of taxes on profit is made.

This table indicates the change of customs rate for 100 tones of maize with a customs value of BIF 30,960,000 before and after exemption (Burundian francs).

Source: Burundi Revenue Authority (OBR)

IWACU Open Data

IWACU Open Data